Is Black Friday Dead?

- Richard

- Nov 4, 2025

- 6 min read

Updated: Nov 26, 2025

I remember when Black Friday was adopted here in the UK, following in the footsteps of the wholy American event, leveraging the purse of shoppers after Thanksgiving. Well, it seemed us Brits didn't need the excuse of Thanksgiving to bag a bargain and instead, we identified the opportune seasonality of encouraging sales in the month before Christmas as an excuse. And so, the masses descended upon retailers to fight over TVs, toys and clothes, like from some apocalyptic scene. Thinking back, it was all a bit bizarre, but the novelty of Black Friday in the UK was lapped up and the retailers rubbed their hands with glee. Next year would be bigger and better. Marketing comms and POS would extravagantly announce Black Friday deals, while it's lifespan increased throughout the month of November, with more deals, offers and coupon codes than ever before.

Then, while we thought it couldn't get any bigger, the pandemic hit. Those two years of lockdown also saw the biggest ever Black Friday periods as people shifted their buying behaviour from bricks and mortar to the internet. Ecommerce as a whole saw the biggest boost ever from this seasonal trend, with retailers preparing months in advance, readying their systems, attaining more bandwidth and bolstering their fulfilment to deal with the exponential increase in demand. Working in ecommerce at the time felt frenetic and dizzying, watching the sales numbers by the hour, comparing it with the performance of the year before.

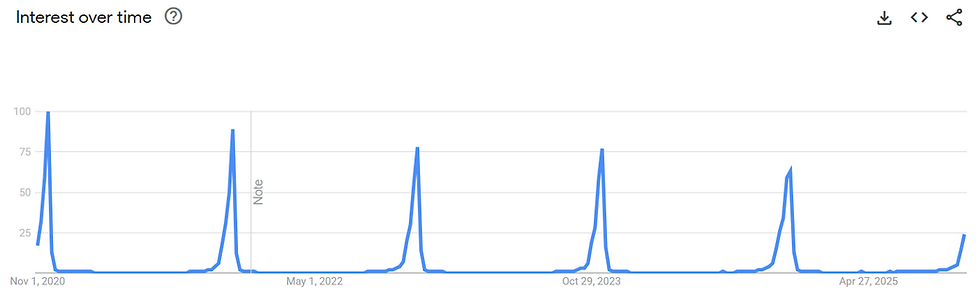

For those few years, Black Friday was the event of the year, outshining Christmas and January Sales, but the bubble would eventually burst. Well, maybe not burst, but more like fizzle away slowly. We can see this evident in the Google search trends results. The "Black Friday" search term volumes are decreasing year on year and most, if not all online retailers will have acknowledged this.

The Black Friday Fizzle

Ironically, the rise in popularity for Black Friday was also the beginning of the end, so let's take a look at this timeline. I think we can all agree, the pandemic was a crazy time for everyone, and not just in our personal lives. Business shifted more towards digital and those that didn't adapt, got left behind. Pre-existing online businesses had the leg-up already and saw growth with very little effort, but this growth was artificial. Sales increased naturally all year round and Black Friday was just the cherry on top. The entire UK economy shifted, for better or worse, which came into being not long after Brexit was finalised. Ecommerce did a lot of heavy lifting during this time out of necessity. Of course, these phenomena wouldn't last forever.

Soon after the pandemic, we were hit with the cost of living crisis and consumer confidence hit an all time low. Interest rates sharply rose. Many people were still out of work from the lockdown redundancies. Russia decided to invade Ukraine again. buying behaviour shifted once more as normalcy resumed. The gravy-train which many online retailers enjoyed was ending abruptly end and this would also have a knock-on effect with Black Friday.

For the first time in the best part of a decade, sales volumes started to decline year on year and all those punchy forecasts during the pandemic might as well be toilet paper now. So what do you do when you need to increase sales? You get more aggressive. Consumers were swamped with year-round discounts and promotions in a last ditch effort to grab their attention, while retailers hoped they could recoup some of the loses from all that stock and overheads they invested in the prior year. The result was that Black Friday inevitably lost it's potency. Why would shoppers bother with a sale when they already got what they wanted from the Halloween sale, or the Autumn Sale, or the Summer Sale, or the Half Term sale. Take your pick. Black Friday had gone from being the sale of the year, to just another sale within all the noise.

What the stats tell us...

YouGov “UK Black Friday & Cyber Monday outlook 2024”

In the UK, 28% of shoppers said they were undecided about their Black Friday spend for 2024.

NielsenIQ “Early lessons from Cyber Monday 2024”

A report found that in 2024 the weeks leading up to Black Friday showed greater growth than the actual Black Friday week itself — helping show the event’s timing and impact are shifting.

Now, I'm not saying Black Friday isn't still a big hitter. There's definitely some juice left in the squeeze, but it's now a question of effort versus reward. We may yet see the continual decline of Black Friday as the seasonal retail event of the year. I'd encourage you to take a look around and see for yourself. Compare it to a few years ago. Maybe you'll notice less marketing emails, fewer billboards and not so many adverts.

You're probably thinking this is all doom and gloom, especially as a marketer, but like with everything in business, there is always an opportunity, it just requires a shift in focus. No longer can you just increase sales through blunt force in a market which is already saturated by deals and offers. You need a different approach.

Time for Something New

In some ways, it's quite liberating, being free from the stress and performance anxiety of Black Friday. We can go back to the days of building quality brands, without seeing who can sell something for the lowest price. We're returning to brand loyalty and cultivating our audiences, where businesses offer something more substantial to it's market, rather than just milking them. So, if not Black Friday, then what?

Retailers are shifting their focus away from short-term spikes and towards long-term relationships — building loyalty, engagement, and community rather than chasing a single day of chaos. The brands thriving today are the ones that understand that connection, experience, and authenticity are the new currency of ecommerce.

Gamification and Interactivity

Gamification has become one of the most effective ways to keep customers engaged beyond sales events. Nike’s Run Club app, for example, rewards users with badges, challenges, and exclusive product drops, turning engagement into a game rather than a transaction. LEGO uses a similar approach, rewarding its fans for sharing their creations or leaving reviews — proof that loyalty can be fun, not forced. Even ASOS and Sephora have added interactive discount games like “spin to win,” making promotions feel like play rather than persuasion.

User-Generated Content and Community

Then there’s the rise of community-led brands — those that make customers part of the story. Gymshark, for example, built its success not on discounts, but on people. From resharing gym transformations to collaborating with everyday athletes, it created a tribe, not a customer base. Glossier did the same for beauty, giving the spotlight to its fans and their authentic content. And closer to home, brands like SkateHut are embracing UGC through creator partnerships and community videos — celebrating the culture behind the product, not just the sale.

Loyalty, Not Just Discounts

Discounts might win a sale, but loyalty wins a customer. That’s why more retailers are investing in membership programmes that feel rewarding all year round. Starbucks Rewards and Adidas Creators Club both show how to make loyalty addictive — offering perks, access, and exclusivity. Even smaller brands are adopting this model. Gravity Fitness, for example, has explored points-based systems to reward engagement, not just spending. It’s a smarter, more sustainable way to grow.

Purpose and Experience

Finally, brands with purpose are cutting through the noise. Patagonia’s iconic “Don’t Buy This Jacket” campaign proved that standing for something bigger than a sale builds loyalty that money can’t buy. The same goes for brands like TOMS or Who Gives A Crap, whose customers stay loyal because they believe in the mission. The result? Repeat purchases rooted in shared values, not shallow discounts.

Maybe Black Friday doesn’t need saving — maybe it’s simply evolving. The future of retail won’t be about how loudly you can shout your offers, but how deeply you can connect with your customers. The brands that win now are the ones that focus on meaning over markdowns, loyalty over panic buying, and storytelling over sales events.

Comments